CHICAGO — The Center for Exhibition Industry Research (CEIR) released its Q4 2023 Index Results, showing a strong improvement in Q4 marked by extremely low cancellation rates and continued improvement in metrics that brought the Q4 2023 Index value to 92. The CEIR Total Index was up 15% from the year prior.

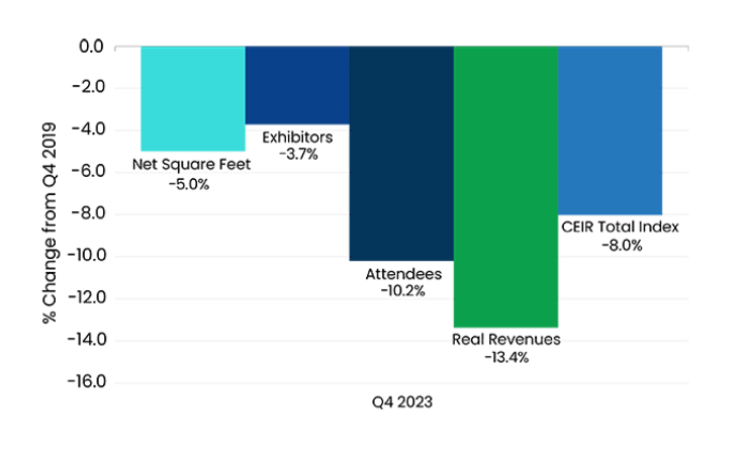

Momentum was strong in the final quarter of 2023, with the CEIR Total Index up 6.6 percentage points from Q3 of the year (-14.6%). CEIR reported that performance was just 8% lower than it was in 2019 for the same period, which is an impressive improvement compared to 2021 (–41%) and 2022 (-20%).

“CEIR’s Omnichannel Marketing Insights series, done during the pandemic, polled attendees and exhibitors who had participated in events pre-pandemic. It found that most exhibitors and attendees would return to B2B exhibitions once the industry reopened. The reason why they planned to return is because of the high value and effectiveness that the face-to-face channel delivers against the business reasons for participating,” said Nancy Drapeau, IPC, Vice President of Research at CEIR.

“As business visa requirements loosen, more international exhibitors and attendees are returning though visa wait times remain a challenge in some countries,” Drapeau said. “Economic growth remains strong though travel costs remain high. Even so, we see event performance continue to improve.”

There was also an increase in the number of events that surpassed pre-pandemic levels in Q4 from 2022 (23%) to 2023 (31%).

“That 31% have beat 2019 results in Q4 2023 vs 23% in Q4 2022 speaks to the slow process for other events,” Drapeau said. “They are recovering, but not yet surpassing their 2019 results. What is important is that each quarter, more organizers achieve this benchmark or are getting closer to this benchmark. It will take time. Yes, we do expect the percentage of events reaching pre-pandemic levels will surpass 50% and approach 100%. At the same time, one must keep in mind business cycles of events and sector-specific trends that could impose headwinds that make recovery tougher.”

When looking at the metrics relative to Q4 2019, net square footage is down 5%, exhibitors are down 3.7%, attendance is down 10.2%, real revenues are down 13.4% and the CEIR Total Index is down 8%. While nominal revenue was 3.7% higher than in 2019, higher costs from inflation brought real revenues down.

Related. CEIR Releases Book Detailing Cost-Saving Tips for Exhibitors

According to the report, the recent growth has been boosted by the slow in inflation, easing market conditions and a strong labor market. These factors are also making economic outlook for 2024 “modestly positive,” along with “healthy household and nonfinancial corporate balance sheets.”

CEIR has partnered with Tourism Economics, an Oxford Economics Company, to produce the CEIR Index. Through the partnership, Tourism Economics is now tracking and analyzing the performance of B2B exhibitions in the U.S.

“The latest CEIR Index results run along the lines of what CEIR has forecasted over the past three years. As expected, the industry’s rebound from COVID is steadily showing signs that the exhibitions industry should reach full recovery this year,” said CEIR CEO Cathy Breden, CMP Fellow, CAE, CEM.

The CEIR Index Report will be published in late April of this year, and it will include a forecast through 2026.

Reach Nancy Drapeau at ndrapeau@ceir.org