The theme this fall is reconnection, says Ken Holsinger, Freeman’s SVP of Data Solutions, and he is not shy in telling us it’s time to get our boats back in the water. “Frankly, we’re desperate to reconnect. Exhibitors are back. They want to see you. Their number-one priority is you, and we should focus on in-person because there is pent up demand for that return. It’s all about getting back to face-to-face.”

The theme this fall is reconnection, says Ken Holsinger, Freeman’s SVP of Data Solutions, and he is not shy in telling us it’s time to get our boats back in the water. “Frankly, we’re desperate to reconnect. Exhibitors are back. They want to see you. Their number-one priority is you, and we should focus on in-person because there is pent up demand for that return. It’s all about getting back to face-to-face.”

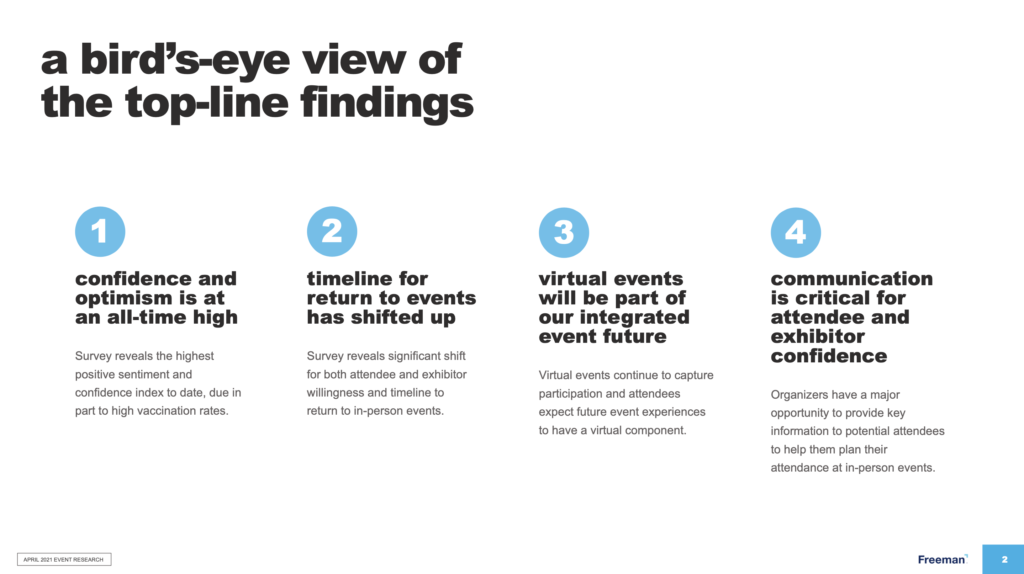

Sharing the results of a new research study, Freeman, the global leader in events, has concluded that the timeline for the return to in-person events has moved up, with 85% of attendees and 86% of exhibitors expecting to return to in-person events by the winter of 2021. From February to April 2021, overall positive sentiment increased from 30% to 45%, and negative sentiment decreased (unaided) from 51% to 36%. “It’s now more positive than negative,” said Holsinger.

When surveyed in February, only 74% of attendees and 78% of exhibitors expected to return to the show floor by the end of the year. Holsinger says that the topline view of tracking confidence and optimism is at an all-time high, meaning the timeline for a return to events for fall has strengthened significantly, with added confidence for even as early as July and August. The research is based on data from more than 1 million U.S. event attendees, exhibitors, organizers and brand marketers, and includes 20% international attendees, with a +/-1 % margin of error, to provide a broad-brush view of where trade show producers are now, and where their deepest concerns lie.

“People are clamoring for information that will help them determine what happens in the fall,” Holsinger said, adding that we’re all looking for a timeline for a return to live events. “We are seeing true pent-up demand. Indeed, higher than normal.” This is also where show organizers have a major opportunity and responsibility to provide key information to potential attendees to help them plan their attendance at in-person events.

Using a unique algorithm, the study’s Confidence Index started at .42, indicating very low confidence. “But now, we are almost double that,” Holsinger said. “Our benchmark was .8 or higher to drive decision making; we are there at .81%.” In this data-driven scenario, attendees and exhibitors are clearly ready. “But this message needs to be driven home and shared with local authorities,” Holsinger said.

So what do those exhibitors need to hear to prepare for those fall events?

Related. Freeman Offers Expert Advice for Designing Safe and Engaging In-Person

Clear and Timely Communication Required

With September just four months away, Holsinger said that the ability to make these decisions now and empower organizers to drive clear communication is very important. It also can be frustrating, especially in areas and cities that have not shared clear and consistent guidelines.

While communication about health and safety to attendees and exhibitors is critical, Holsinger said show organizers don’t need to share all the minutiae. “For example, we don’t need to know the details of how the fire department keeps us safe; we just need to know they know [how to do that]. That’s where we’re at in the industry. We can over-communicate details to attendees instead of saying, `We’re the pros; we know what we’re doing.’”

While Freeman’s research explains that attendees want to understand the specifics of vaccines, as well as the status of the pandemic, Holsinger urged show producers to “Point them to the authorities. What’s happening at their own hotel is what matters. They want to understand: What do I need to know about that event in Chicago and the venue and hotel I am going to?” This is the organizer’s opportunity to make it personal. If you’re attending an event in Orlando, the status of Florida is less important. “Narrow it down,” he urged.

Holsinger also recommended that show producers transition their thinking from a risk/reward mindset to reward/risk mindset. “We can get so focused on the risk, we forget that what we do in this industry is the reward side. It’s about connecting with other humans and getting back together with other humans. The reason we love the industry so much is the relationships.”

Related. COVID Vaccine Rollout Fuels Optimism for the Trade Show Industry

Event Pros Get the Jab

Event Pros Get the Jab

Holsinger said that vaccines are a big part of what is inspiring this optimism, which bodes particularly well for event industry professionals who are more likely to take the vaccine than the general population.

“Studies show that age, education and income are the primary drivers of the decision to take vaccines,” he said. In February, only 52% of the U.S. general population was ready to take the vaccine right away; that number is now almost 70%. However, among event professionals, with an average age of 48, average education five years post high school, and an average salary of $125,000 or more, the number is 80%, with only 15% considering the vaccine, leaving only 6% who will not take the vaccine.

“Event professionals are far more optimistic, particularly after they’ve been vaccinated,” Holsinger said. “As we close the gap with those who have taken the vaccine, we see it drives their optimism up to 88%.”

Lifting Travel Restrictions

Freeman’s research paints a potentially rosy-hued picture, with 74% of respondents believing they will have no travel restrictions in place by fall of 2021. This coincides with when most attendees and exhibitors (75%) expect to return to in-person events.

“Now we’re in virtual only, despite a few shows,” Holsinger said. “In the near term — June through August — we’re seeing lots of toes in the water, with smaller, in-person events. But next, we’ll see the return to larger in-person events begin as we move into fall.”

Exhibitor likelihood to exhibit at an in-person event increased from 68% to 80% and those “unlikely” decreased from 14% to 8%, representing the highest values to date from both exhibitors and attendees. By winter this year, 86% of exhibitors expect to return to live events.

Holsinger reminded that corporate and sales travel will remain limited for some time due to financial recovery and caution and should not be considered the same as meeting and event travel. “You need to dig below the headlines to see the true numbers.” As businesses restart, Holsinger advised that it’s important to remember that while interoffice travel is generally not considered essential, meetings and events are deemed essential travel for both attendees and exhibitors.

Attendee Personalization and Quality

Holsinger believes the industry conversation about personalization is long overdue. “This is our opportunity to be much more segmented and focus on our audience more than ever,” he said, adding that the last 20 years has seen the slow but steady collapse of the persona between our professional work environments, and our personal home lives. “And COVID has only accelerated what was already happening. The research is very clear: Our consumer and professional personas are blended. Our desire for personalization and flexibility, and an understanding of trends driving consumer behavior, are things every organizer should be on top of, as well as how it intersects with their community.”

To that end, Holsinger stressed the critical importance of communicating attendee quality to exhibitors. “As an industry, we generally only share numbers, not the `who’ [is attending], and we do a disservice talking only about numbers when quality is far more important.”

Holsinger believes that in the future, early registration patterns will not be recognizable from pre-COVID days. Generally, about 50% of registrants take advantage of early-bird registrations but Freeman’s research concluded that the most qualified attendees typically register late, during the last three to four weeks before show time. These late registrants tend to be the busiest executives and typically wind up with leftover hotels and last-place seating. “We’ve tended to reward loyalty over quality and we need to take a careful look at that. We don’t want to shut out our most qualified attendees,” he said, advising show managers to be particularly wary when closing out quotas with early registrants.

While he is cautiously optimistic about the return to live events, Holsinger urged trade show professionals to share this data-driven message with local authorities, to help spread the conviction that the industry can indeed hold these events safely.

Hybrid and Virtual: Here to Stay

“In-person events are irreplaceable” 87% of attendees agreed, and many are willing to go to smaller in-person events even more readily than before. While only 5% of exhibitors are willing to pay for hybrid or virtual experiences beyond the return to in-person events, Holsinger believes that can be dramatically improved when we view hybrid as an asynchronous opportunity. “There is no evidence we can see that there is a desire for everyone to be online and in-person at the same time enjoying a kumbaya moment,” he said, likening this to attending a basketball game in-person with court-side seats, versus watching it at home.

“When we’ve got court-side seats, the most communication we might have is sending a selfie to our friends because we’re going to focus for several hours on the moment we’re in, the experience we’re in, the food, the drinks and the company. Our friends at home? They’ll have a drink and go from tip off until the game gets boring, or, if it’s exciting, the final buzzer.”

Reach Ken Holsinger at ken.holsinger@freeman.com (214) 445-1000