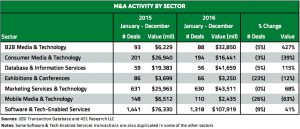

New York — M&A activity in the exhibitions and conferences sector declined 23% in deal volume in 2016, but still saw 66 transactions totaling $3.3 billion vs. 86 deals worth $3.7 billion in 2015, according to a report by JEGI, an investment bank serving the media, information, marketing, software and tech-enabled service sectors.

New York — M&A activity in the exhibitions and conferences sector declined 23% in deal volume in 2016, but still saw 66 transactions totaling $3.3 billion vs. 86 deals worth $3.7 billion in 2015, according to a report by JEGI, an investment bank serving the media, information, marketing, software and tech-enabled service sectors.

Notable deals in Q4 2016 included the UBM acquisition of Allworld Exhibitions Alliance, for $485 million. Allworld operates trade shows for several sectors in the Middle East and China.

Across the media, information, marketing, software and tech-enabled service sectors, deal value in the M&A market surged in 2016 to nearly $220 billion, driven by mega deals like Microsoft’s $29 billion acquisition of LinkedIn. In the face of rebounding consumer and business confidence, deal value for last year was 44% higher than 2015’s $152.3 billion, but the number of M&A transactions declined from 2,342 in 2015 to 2,157 in 2016, according to JEGI.

With robust equity and debt markets, as well as excess cash in the hands of both corporate and private equity buyers, JEGI expects M&A activity to remain strong in 2017.

Reach Adam Gross at (212) 754-0710 or adamg@jegi.com