DALLAS — The Center for Exhibition Industry Research (CEIR) released the 2019 CEIR Index Report, an analysis of the 2018 exhibition industry and an economic and exhibition industry outlook for the next three years. For the second year in a row, the total index grew at a slower pace the U.S. economy. In 2018, the total index, a measure of overall exhibition industry performance, increased by 1.9%, compared with 2.0% in 2017.

DALLAS — The Center for Exhibition Industry Research (CEIR) released the 2019 CEIR Index Report, an analysis of the 2018 exhibition industry and an economic and exhibition industry outlook for the next three years. For the second year in a row, the total index grew at a slower pace the U.S. economy. In 2018, the total index, a measure of overall exhibition industry performance, increased by 1.9%, compared with 2.0% in 2017.

At the same time, the U.S. economy accelerated last year, rising from 2.2% growth in GDP in 2017 to 2.9% in 2018, representing nine consecutive years of growth. By comparison, the total CEIR Index has been in positive territory since 2012.

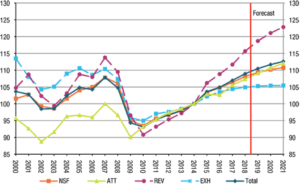

CEIR reported that four key exhibition industry metrics rose in 2018, with real revenues leading at 3.6% above 2017 levels. Attendance and net square feet (NSF) rose 1.7%, while exhibiting companies grew by 0.5%.

Exhibition industry performance varied widely by sector in 2018. The leading sector was government, surging 7.8%. Food and discretionary consumer goods and services also posted strong gains, rising by 5.4% and 3.6%, respectively. On the other end of the spectrum, the sector most challenged was financial, legal and real estate, which declined by 2.6%, followed by consumer goods and retail trade, which dropped by 1.8%.

In 2018, the exhibition industry’s performance finally surpassed its last peak and is now anticipated to break new ground performance-wise through 2021. (See chart) “Previously, the exhibition industry peaked in 2007,” CEIR CEO Cathy Breden, CMP, CAE, told Trade Show Executive. “The forecast is predicting growth but at a slower pace over the next three years.”

GDP expansion in the next few years will be driven by moderate growth in personal consumption expenditures and private investment spending; higher spending levels of both are helped by recent tax cuts, according to the CEIR analysis.

The CEIR Index predicts: “Moderate increases of government expenditures will provide an additional boost. Personal and business spending growth will soften as the impact of tax cuts diminishes, and a widening trade gap will limit potential overall expansion.” According to CEIR’s current projection, real GDP growth will ebb to around 2.5% in 2019 before decelerating further to 2.0% in 2020 and 1.8% in 2021.

“Moderate economic, job and personal disposable income growth should continue to drive exhibitions,” said CEIR Economist Allen Shaw, Ph.D., Chief Economist for Global Economic Consulting Associates, Inc. “However, the downward secular trend in financial, consumer goods and Education will exert a drag on the overall performance of the exhibition industry. CEIR expects the Total Index growth to slow to 1.4%, 0.5 percentage points lower than the 2018 rate and 1.0 percentage point behind real GDP growth. Exhibition performance will further slow modestly to 1.1% in 2020 and 0.8% in 2021 as the economy settles into a slower but more sustainable growth path.”

To purchase the full report, go to: https://www.ceir.org/products/2756

Reach Cathy Breden at (972) 687-9201 or cbreden@iaee.com.